The following tax tables were updated and apply from 1 July 2023. Tax tables that were updated and apply from 1 July 2023 The legislated stage 3 income tax cuts are not due to commence until 1 July 2024 (the 2024-25 income year). There are no changes to other withholding schedules and tax tables for the 2023–24 income year. Study and training support loans weekly, fortnightly and monthly tax tables.Schedule 8 – Statement of formulas for calculating study and training support loans components (NAT 3539).

With the annual indexing of the repayment incomes for study and training support loans, the following schedule and tax tables were updated for the 2023–24 year: Important information – July 2023 updates Tax tables for previous years are also available at Tax rates and codes.

To get a copy of the PDF, select the tax table you need and go to the heading Using this table or Using this schedule.

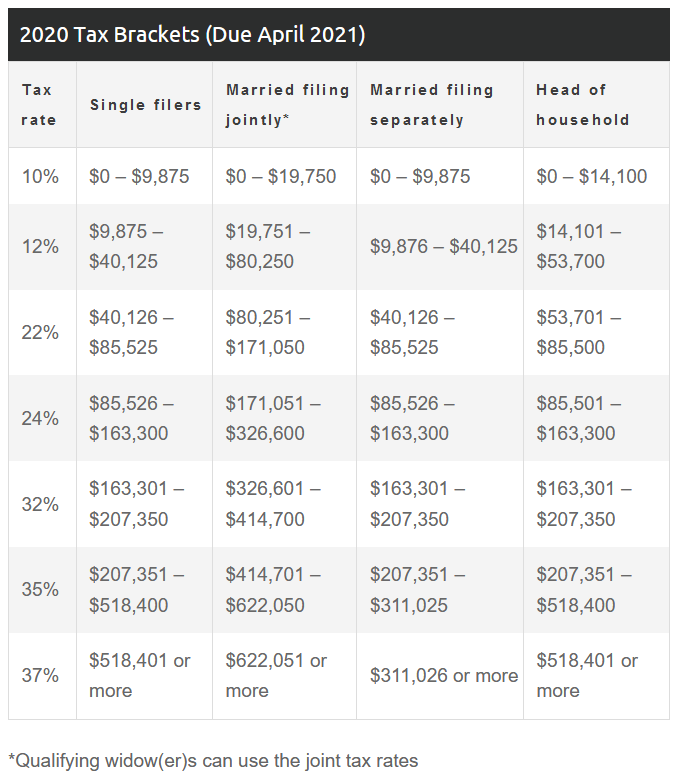

Current 2022 tax brackets portable#

Tax tables with an asterisk (‘*’) have downloadable look-up tables available in portable document format (PDF). A tax withheld calculator that calculates the correct amount of tax to withhold is also available. We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees. Tax tables that continue to apply from 1 July 2023.Tax tables that were updated and apply from 1 July 2023.Important information – July 2023 updates.Use these quick links to find the pay as you go (PAYG) withholding tax tables.

0 kommentar(er)

0 kommentar(er)